How to Secure Investors for Real Estate Development Projects

Types of Capital

Debt

Real estate development projects usually demand significant amounts of capital upfront which makes it difficult for developers to fund 100% of the capital with their own equity. In order to meet these financing needs, developers utilize a combination of equity and debt financing. This combination can provide significant advantages such as tax advantages, lower interest rates, maintaining ownership, and amortization benefits. Different types of debt have different features. Listed below is a sample of potential debt sources:

Construction Debt

Construction Debt is a type of financing used to cover the costs when construction or rehabilitation of a project begins. These types of loans are short term and carry interest rates that are paid monthly during the construction phase. The interest expense during the construction period is included in the development budget. Once the project is completed, the loan converts to a permanent mortgage and is locked at a predetermined interest rate which could either be a fixed rate, or a floating rate. Construction debt covers costs to pay for land, labor, materials, closing costs, permits, and fees. A bank is the most common lender for construction loans.

See below for an example of how construction debt is modeled in our Top Shelf Multifamily models:

Each blue cell in the construction debt assumptions box is an input cell that allows for all details of the construction debt to be customized on a deal by deal basis. Our models allow for the LTC, construction start month, interest rate details, and origination/exit fees to be customized to match the terms of the construction debt.

Senior Debt/Bank Debt

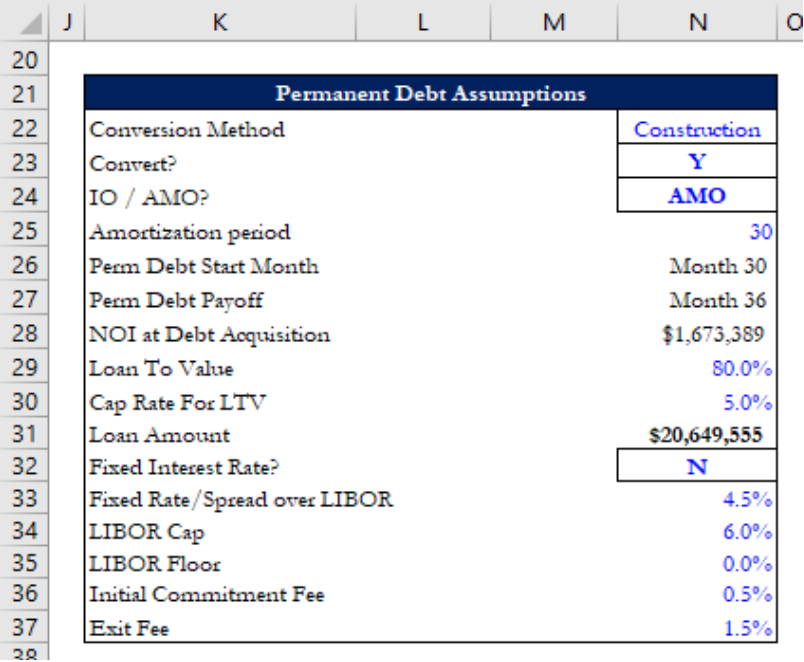

After construction is complete, the Construction Debt is either converted to Senior Debt with the same lender, or refinanced with Senior Debt. Senior debt is the cheapest source of funding real estate developers can secure due to its seniority in the capital structure and the collateral provided in the form of assets (~60% - 80%). These senior loans amortize over time and tend to have low interest rates, either fixed or floating. If the Senior Debt is floating, it will be priced using a benchmark rate such as LIBOR or Treasury plus a spread which adds a number of basis points based on the risk of the loan. However, any nonpayment of obligations gives the lenders additional control. In order to determine how much debt a project can take on, the Maximum Loan to Value and DSCR needs to be calculated. These calculations take into account the amount of debt that can be contributed and whether the cashflows will be able to cover interest payments. See below for an example of how senior debt is modeled in our Top Shelf Multifamily Development models:

Like the construction debt assumptions, all the blue cells are inputs that allow for senior debt to be customized on a deal by deal basis. For example, Cell N23 contains a yes or no toggle that tells the model whether the deal has senior debt or not. Cell N22 tells the model if the permanent debt is based on LTV or if it is refinancing the construction debt and cell N24 indicates if the debt has an interest only period. Additionally, the amortization period, LTV, cap rate for LTV, interest rate details, and origination/exit fee percentages of LTV can all be inputted to match the terms of the deal’s senior financing.

Private & Hard Money Lenders

Hard money lenders are organized semi-institutionalized lenders who are licensed to lend money to those in need. Private money lenders are individuals with access to capital and a penchant for investing it. This type of loan is most commonly associated with flipping residential housing. The Investor purchases the house, improves the house over a few months and then sells. Traditional lenders won’t lend to that type of strategy which makes the Private/Hard Money Lenders a great option for short-term financing.

Private and hard money lenders aren’t associated with institutionalized banks, and therefore aren’t subject to as many restrictions. Instead, these lenders tend to work for themselves, and are usually actively looking to lend out their own funds to those in need. These lenders can award investors with short-term, high-rate loans based primarily on the subject property (12% - 15%). Otherwise known as asset-based lending, private and hard money lenders will base their decision to lend money out on whether the property in question appears like a worthy investment.

Mezzanine Debt

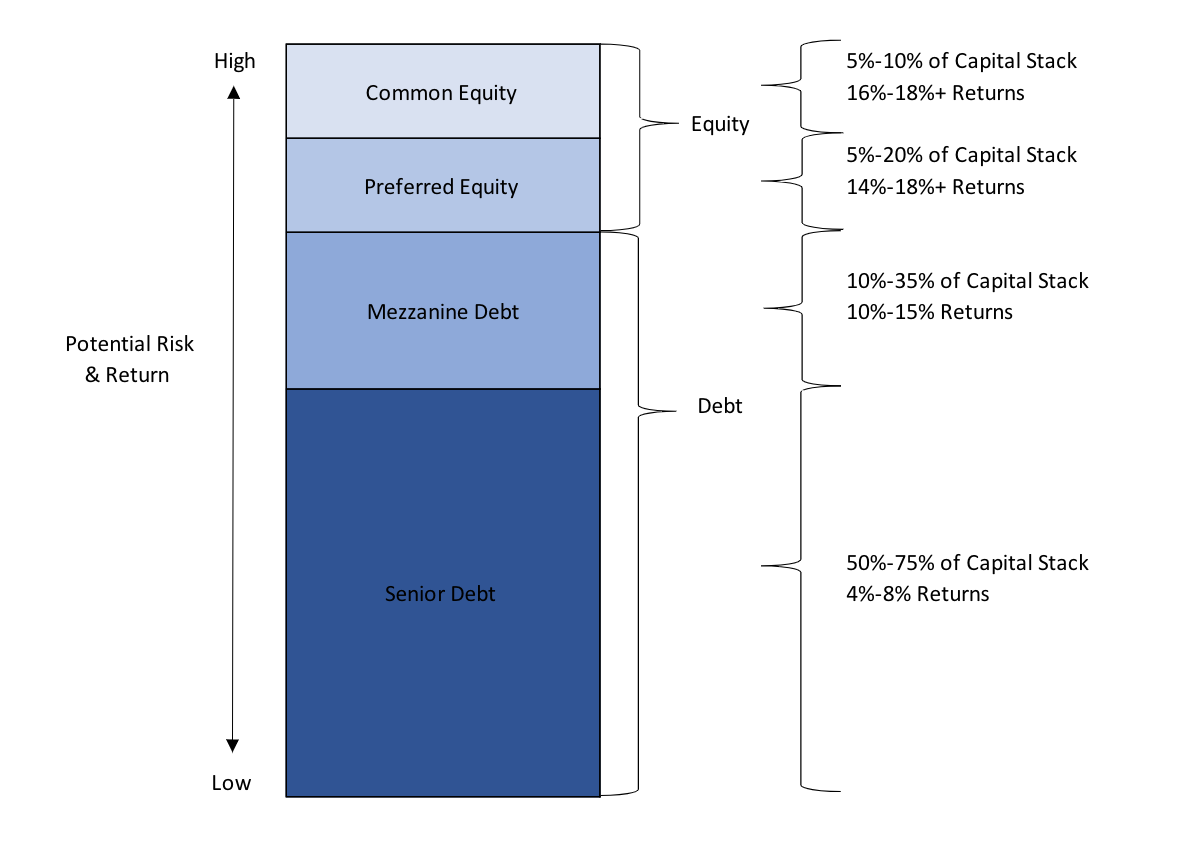

Mezzanine debt is one of the several bridge financing options available to real estate developers, typically accounting for ~10% - 35% of the total capitalization of the project. For a commercial real estate project, mezzanine debt can offer flexibility and enhanced overall return potential to the borrower, while offering a fixed interest rate over a relatively short investment term. It is subordinated or has preferred equity features and is ranked below senior debt, but above common equity in the capital stack.

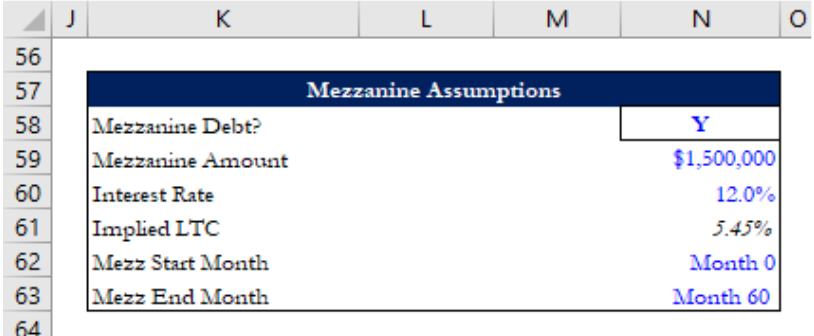

It is usually used when the borrower has taken out the maximum amount of bank debt but needs additional funding. Since this kind of financing is unsecured, it carries higher risk and higher interest rates. It is most common for the interest on Mezzanine Debt to be “soft pay” meaning that the interest expense accrues and is repaid in full with the final repayment of the loan. See below for an example of how mezzanine debt is modeled in our Top Shelf Models:

Cell N58 is a yes or no toggle that tells the model if mezzanine debt is being used to help finance the deal being modeled. Our models then allow for the mezzanine debt amount, the interest rate, and the start/end months of the loan to be inputted to customize the debt assumptions for each specific deal.

Loans

HUD Loans

The Department of Housing and Urban Development or HUD was founded in 1965 and was created to establish policies and programs to address housing needs in America. These programs and policies aim to improve and develop communities everywhere while enforcing fair housing laws. HUD plays a major role in supporting homeownership by underwriting loans for lower income families though its mortgage insurance programs. HUD loans take months to secure, so some developers secure their project with Private or Hard Money Lenders or Bridge Loans until the HUD loan is in place.

Bridge Loans

A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation. It allows the user to meet current obligations by providing immediate cash flow. Bridge loans are short term, up to one year, have relatively high interest rates and are usually backed by some form of collateral, such as real estate. Bridge loans typically have a faster application, approval, and funding process compared to other loan types. For example, if a buyer has a lag between the purchase of one property and the sale of another property, they may turn to a bridge loan. Typically, lenders only offer real estate bridge loans to borrowers with excellent credit ratings and low debt-to-income ratios.

Equity

Equity financing can be classified generally into two categories: Limited Partners and General Partners. Equity financing involves selling a portion of ownership of a project in return for capital. Limited Partners are outside investors investing in your project in exchange for an ownership stake. The General Partner equity is the equity contributed by the owner/developer of the real estate project. Equity financing does not require repayment and provides all equity investors incentive to maximize returns. There are different types of equity, and they can be raised from real estate funds, high net worth individuals, family offices, crowd sourcing, etc.

See below for a brief description of different equity sources:

Limited Partner Equity

Real Estate Funds

A Real Estate Fund is a fund that pools money from different investors to exclusively invest in real estate. These funds are a source of equity funding for projects and have gained popularity among investors due to its ability to diversify portfolios, hedge against inflation, and hedge against volatility.

High Net Worth Individuals

High net worth individuals incorporate real estate into their portfolios by investing directly in real estate equity, REITs, real estate funds, and family offices. These funds are then managed and allocated to fund various projects depending on investors risk appetite and preferences.

Family Offices

Family offices invest and manage funds of wealthy individuals with the purpose of sustaining long term wealth and prosperity. They pool funds from their family to invest in a range of asset classes to maximize returns. Similar to the strategy used by high net worth individuals and real estate funds, they invest significant amounts in real estate as it is income generating, relatively stable, and diversifies the portfolio.

Crowd Funding

Real estate crowd funding is a way for developers to obtain capital for projects beyond their reach by pooling financial and intellectual resources. These funds transact online and use social media to gain unparalleled access to various investors. This platform allows developers/owners to gain access to these funds without much diligence during initial stages.

General Partner/Developer Equity

General Partner/Developer

General Partners are the sponsors of a project and they usually invest alongside the Limited Partners in the investment. The General Partners are expected to contribute substantial amounts of capital to show the Limited Partners that they have a vested interest in the investment performing well.

GP Co-Invest Funds

A GP co-invest fund is a where investors invest directly into the General Partner’s entity and share in the promote, its share of investor distributions and sometimes even fees received by the General Partner. The General Partner is usually reluctant to give away a share of its promote, but these GP Co-Invest funds can be valuable to scale up the General Partner and allow them to grow the business.

Emerging Manager Funds

Emerging Manager funds are private equity/alternative asset class investment funds that invest in startup funds. Developers obtaining capital from these funds usually for their first fund in exchange for promote in the first two or three funds raised by the General Partner. The Emerging Manager fund helps the General Partner with back-office support and to get them organized to run future funds on their own.

Once the General Partner has a successful track record, they would not need the Emerging Manager Fund.

Employee Equity

Employee equity is another way the General Partner can contribute equity into the investment. Employees can be invited to contribute equity to the General Partner to reduce the amount of equity needed to be funded by the principals.

Capital Stack

Investors usually look at a capital stack to determine the risk and order in which they will be repaid. Capital stacks are the different layers of financing sources that go into funding the purchase and improvement of a real estate project.

Conclusion

In conclusion, while the sources of funding for a real estate development project are crucial, investors need to understand how to get the money, and how to appeal to those that have the money. Having a convincing and detailed plan along with a committed and compatible team working toward the same goal are just as important in successfully pursuing an opportunity.

Before founding 3E in 2016, Managing Member Eric Bergin was Director at Rockpoint Group, where he was responsible for for the Finance Group, as well as acquisitions, asset management, and investor reporting activities.